Success Story: Evo Banco

Evo Banco is the digital bank of Bankinter, that aims to reinvent finance for a better future. Evo represents a new way of banking, one that is intelligent, simple, transparent, and innovative. It offers its customers all the ease, agility, and convenience of online banking along with the closeness and professionalism of a network of physical offices.

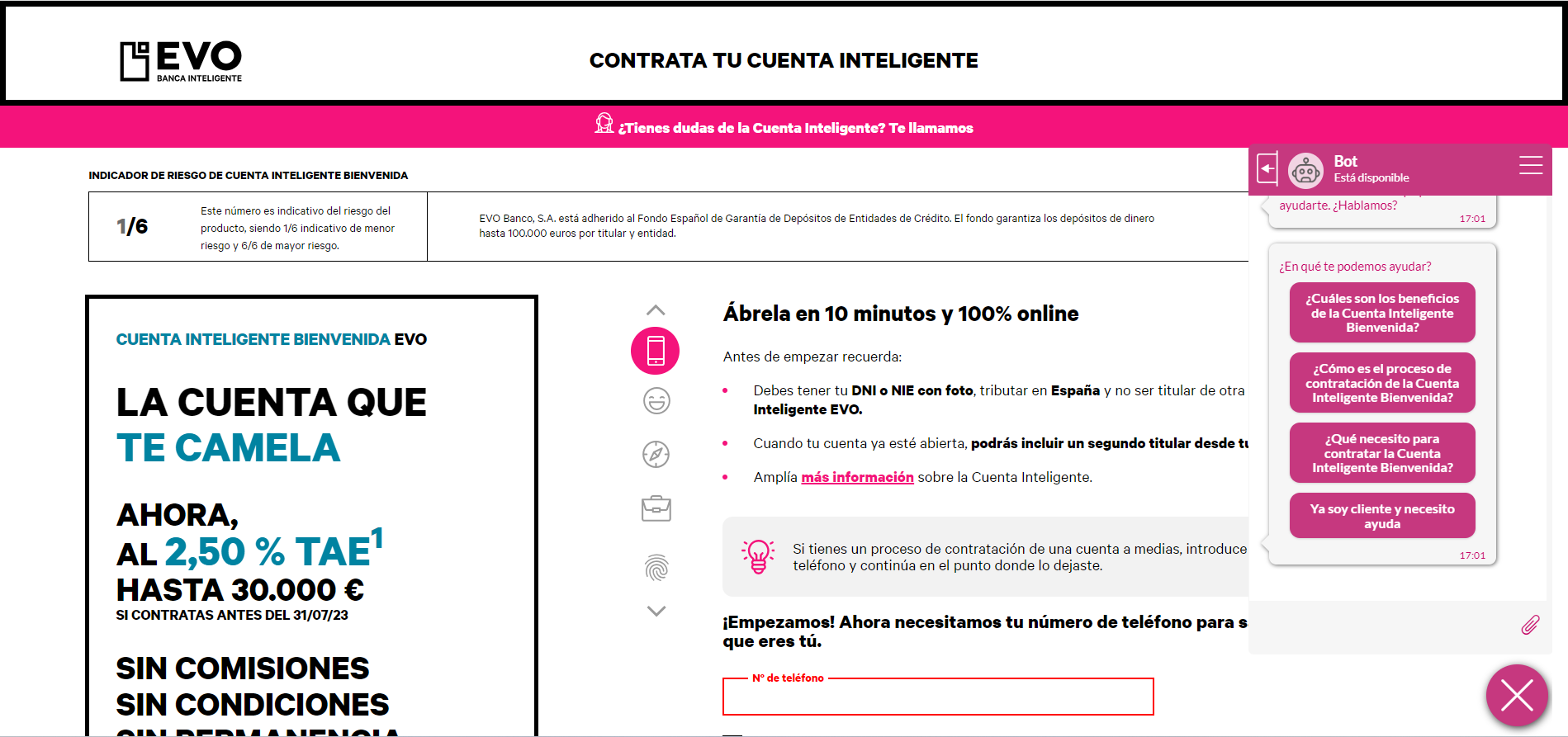

A Smart Chat for a Smart Bank

Evo Banco’s decision to implement Oct8ne on its website was driven by the goal of not having a human agent connected all the time. Instead, they wanted a chatbot/assistant available 24/7 to provide immediate, autonomous, and intelligent responses. This approach aimed to reduce the workload on phone agents and let technology handle product-related questions and the account opening process.

According to Asier De la Torre, Head of SEO & Acquisition for Evo Banco, they wanted to ensure that “if there were any product-related doubts, it wouldn’t be necessary for a human agent to respond, and it could be answered automatically.”

Conversion Strategy

Evo Banco implemented Oct8ne´s chatbot in a specific section of its customer area, focusing on the intelligent account opening process to advise customers through the bot and increase conversion rates. As Asier explains, “For now, we are restricting Oct8ne to cover the onboarding processes, especially to be able to provide a response and obtain a conversion metric.” He adds, “An existing customer has various communication channels, but in the case of the onboarding process, which is critical and where we aim for conversion, we believe this type of flow is where we get the most value. This doesn’t mean that in the future, we couldn’t expand its use to other areas.”

The strategy is clear and achieves its goal. As Asier notes, the conversion rate of financial customers who interacted with the bot in the last 3 months has exceeded 10%.

How Oct8ne is used at Evo Banco

Once customers sign up, Evo Banco offers two possible branches of content for their chatbot: one for questions related to the product the user is signing up for, which is a financial product that, while simple, has unique characteristics and an additional layer of intelligence. The other branch is related to the customer onboarding process, which is typically straightforward, covering steps, necessary documentation, and potential errors.

When a user has a question, they simply click on the button related to their issue to see possible solutions. However, the user doesn’t necessarily have to seek help because if the bank detects a problem in the onboarding process, the Oct8ne chatbot steps in and asks if the user has any specific doubts about that step, providing real-time guidance on common errors people make during the onboarding process.

How did they assist potential customers before implementing Oct8ne?

Evo Banco previously assisted customers through the call center with a human agent overseeing the process, or proactively if they noticed users abandoning the activation process. Additionally, they conducted personalized email campaigns related to abandonment, based on where users were getting stuck in the process and providing assistance to help them continue the onboarding process.

How was Oct8ne implemented?

“The implementation of Oct8ne has been very quick and straightforward,” explains Asier. They autonomously configured the chatbot and, with Oct8ne’s support, implemented and activated the dialogue flows. Evo Banco values how easily they can make modifications to the chatbot’s structure without requiring technical expertise or external support.

What information was considered for Chatbot configuration?

Evo Banco primarily considered two initial lines: the product and problem-solving for account opening. They established that initial questions would be related to the product itself (intelligent account): its features, withdrawal options, ATMs, etc. As the user progresses, the dialogue tree shifts toward solving operational and technical issues at each step of the process. To create the content tree, they relied entirely on the historical data they had regarding customer inquiries.

User feedback on Oct8ne Bot interaction

“It’s good, and in the event that someone says it wasn’t helpful, we redirect them to a phone agent,” confirms Asier. He explains, “There is a high percentage of those who interact with the chatbot to resolve product-related doubts who, after completing the dialogue tree, say it was effective. Approximately 75% of chatbot openings for product-related questions report understanding and finding it helpful.” This contributes to future conversions because the chatbot has resolved their product-related doubts, making conversion more likely.

Evo Banco in numbers

Over a three-month period, Evo Banco received 5,407 help requests, of which 99% were handled by the chatbot. This confirms Evo Banco’s objective of providing autonomous responses to potential new customers, as only a small percentage was directed to human agents. Additionally, 100% of the sessions were initiated without a trigger, meaning users proactively sought help through the chat.

Try Oct8ne’s chat for free now

No credit card required

Companies of all sizes trust Oct8ne to increase their sales: